While the advantages of cold-formed steel over wood framing have been clearly established, some elements of decision-making involving the choice of one over the other have traditionally been associated with pricing.

The cost difference between homes constructed using traditional wood framing and steel framed homes has been a subject of much interest, debate, and, in some cases, misguided interpretations. This article unpacks the essential ingredients for understanding how to price steel-built single-family homes relative to those built with wood, and it also debunks some longstanding myths. By focusing on the total cost of constructed houses and buildings—rather than isolated material prices—we’ll demonstrate why steel framing emerges as the decisively superior option, offering stability, durability, and long-term savings. We’ll draw on historical data, recent studies, and current market trends to provide a comprehensive analysis, incorporating insights from industry reports, economic analyses, and real-world comparisons.

Appropriate Basis for Comparing the Cost of Wood and Steel Framing

One of the most frequently encountered errors in comparing the cost of wood and steel framing is attempting to convert the cost of a wood-built home into a steel-built one by merely replicating the framing. This often involves searching for the nearest similar framing member wrongly perceived as equivalent—for example, simply replacing a Douglas Fir 2×4 stud with an SFIA 362S162-43 Gr. 50 steel stud—and then summarizing quantities on an overall member basis. Another common mistake is applying wood construction metrics, such as hardware and connection material costs, directly to steel-framed projects. Additionally, many overlook the fact that there is no effective way to comprehensively prefabricate with wood due to its bulky weight, dimensional instability, and inconsistency in material properties.

The only correct way to assess the cost of wood versus steel is to price the total cost or unit area of the as-constructed space and make a comparison on that basis. This approach fully captures the technological advantages of steel, such as advanced steel-framing roll-forming technology provided by companies like Scottsdale Construction Systems. This technology leverages the inherent benefits of steel—strength, precision, and durability—while amplifying them through prefabrication and off-site construction methods, whether modular or panelized. Integrated software and automation further enhance these benefits, reducing waste, speeding up assembly, and minimizing on-site labor.

Another critical aspect is the total cost of ownership, which decisively tilts the picture in favor of steel due to significantly lower insurance premiums, reduced maintenance needs, and extended lifespan. Steel’s resistance to fire, pests, and moisture translates into lower long-term expenses, making it a smarter investment over the life of the building.

Debunking Common Myths About Wood and Steel Pricing

Before diving into trends and data, it’s essential to address persistent myths that skew perceptions of wood versus steel framing costs.

Myth 1: Steel Is Always More Expensive Upfront. While raw steel material costs can sometimes appear higher, the total constructed cost often favors steel when accounting for efficiency gains. For instance, steel’s lighter weight (up to five times lighter than wood) reduces foundation requirements and transportation costs. Prefabrication allows for faster assembly, cutting labor hours by up to 30% in some cases. Furthermore, a recent authoritative analysis by McKinsey shows that prefabrication can speed up construction by up to 50%, cut material cost by 10%, and lower the total cost by 20%. Studies show that when optimized, steel framing can achieve parity or even savings compared to wood, especially in volatile markets.

Myth 2: Wood Is More Sustainable and Cost-Effective Long-Term. Wood advocates often cite renewability, but this ignores significant waste—up to 30% in timber projects versus just 2% for light-gauge steel. Moreover, wood’s susceptibility to deterioration drives up lifetime costs. Millions of affordable wood-framed homes in the U.S. are deteriorating rapidly, exacerbating the housing crisis with issues like mold, structural failure, and high repair bills. Steel, being non-combustible and resistant to termites and rot, avoids these pitfalls, leading to lower insurance and maintenance expenses.

Myth 3: Price Comparisons Should Focus Solely on Raw Materials. This narrow view ignores the broader ecosystem. Steel enables wider stud spacing (e.g., 24″ o.c. versus wood’s typical 16″ o.c.), reducing material usage without compromising strength. It also eliminates the need for culling defective pieces, a common 15% adder in wood estimates.

By reframing the comparison around total value, steel’s superiority becomes evident.

Long-Term Trends in Pricing of Wood and Steel Raw Materials

Understanding pricing trends requires examining the volatility and drivers of raw materials for both wood and steel. Lumber, derived from softwood trees, is highly susceptible to supply chain disruptions, environmental regulations, and global demand. Steel, particularly cold-formed steel (CFS) used in framing, is produced from scrap and iron ore, offering more predictable pricing due to recycling and industrial scale.

This compelling visualization of this volatility comes from industry analyses comparing steel scrap and lumber prices. Over recent years, steel scrap prices have shown moderate fluctuations: a 167% peak increase pre-COVID, followed by a -47% drop, and a subsequent 40% recovery. In contrast, lumber has been far more erratic, with a staggering 438% surge during the early COVID period, a -60% crash, and a 114% rebound. This graph underscores lumber’s vulnerability to events like pandemics, tariffs, and natural disasters, while steel remains relatively stable.

From 2020 to 2021, in another analysis, lumber prices escalated 538%, driven by supply shortages and booming home improvement demand, whereas steel rose only 61%. Even in 2024, without a global crisis, lumber jumped 47% from mid-July to November, while steel increased just 1%. These trends highlight wood’s inefficiency: it’s wasteful from the start, with inconsistent quality leading to higher cull rates and on-site adjustments.

Environmental factors further amplify wood’s costs. Logging restrictions under acts like the Endangered Species Act limit supply, and labor shortages in the sector—projected to decline 2-4% by 2033—exacerbate issues. Steel, recyclable and produced efficiently, avoids these pitfalls.

The ongoing high lumber prices, still about 80% above pre-pandemic levels as of recent reports, continue to add tens of thousands of dollars to new home construction costs and cause significant delays due to supply-chain issues. This has prompted many builders to pivot toward cold-formed steel framing as a more reliable and cost-competitive alternative. For instance, when wooden studs were priced at $3-4 each, steel at $6.50 seemed less viable, but with wood now averaging $8.50 per stud, steel has gained a clear edge. The National Association of Home Builders (NAHB) emphasizes that these elevated prices are forcing innovations in construction methods to sustain business viability.

For a deeper dive into commodity pricing volatility, see this LinkedIn post from Scottsdale Construction Systems: Wood Price Escalations.

Pre-COVID Pricing of Wood vs. Steel Framed Structures

Before the COVID-19 pandemic disrupted global supply chains, pricing comparisons between wood and steel framing were already tilting toward steel’s favor, especially when considering quality, efficiency, and insurance benefits.

A landmark 2017 study by the Steel Framing Industry Association (SFIA) analyzed costs of mixed-use buildings (49,900 sq. ft.) in Chicago and New Jersey found steel only 2.61% more expensive upfront, dropping to 0.92% when factoring in lower insurance premiums for CFS’s non-combustible nature. However, a follow-up study in August 2020 revealed a dramatic shift due to massive escalations in wood prices—an 80% increase from mid-April to July 2020. This made the CFS framing package 24% less costly than wood. For the total building, costs in Chicago dropped to $6,396,300 for CFS versus $6,706,300 for wood, yielding a 5% savings ($310,000). In New Jersey, with insurance adjustments, CFS cost $6,436,449 compared to wood’s $6,861,477, resulting in a 6% advantage ($425,028 savings). With caveats that long-term savings (e.g., maintenance) further favor steel, even early pandemic data showed steel delivering better value, and the surge reinforced its edge. This is, of course, based on traditional construction methods associated with wood and cold-formed steel deploying screw connections. However, the next-generation steel automation and the superior riveted steel framing technology provided by the expert roll forming and steel framing technology companies such as Scottsdale Construction Systems, increase efficiencies associated with cold-formed steel framing even further.

Pre-COVID, as a point of reference, lumber averaged around $300-400 per thousand board feet (mfbm). This number escalated to staggering $627 by July of 2020. Clearly, this makes the use of wood difficult to justify compared to far more stable baselines of steel, making steel a reliable choice for builders seeking predictability.

Building with wood is unsustainable over the long run!

The prices of softwood lumber continue to escalate even in 2025. Further complicating the overall picture is the fact that about 85% of all construction lumber in the US is imported from Canada, further raising supply uncertainty and creating a significant dilema as to the long-term viability of wood as a construction material for the major homebuilders such as Lennar, Toll Brothers, and D.R. Horton.

A Compelling Homebuilding Case Study

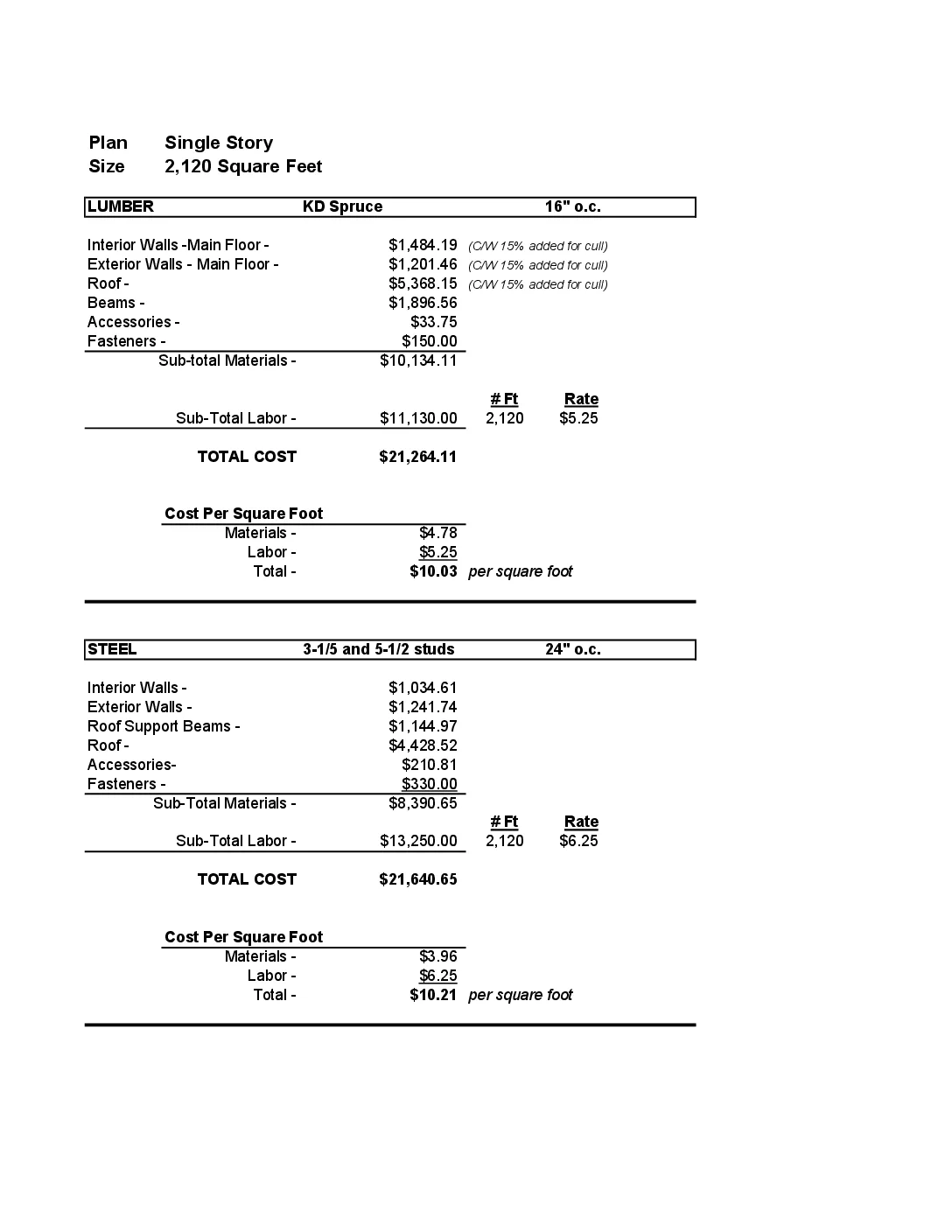

An unpublished study by the Steel Framing Industry Association (SFIA), exclusively brought to readers as a part of this story, analyzed costs for a 2,120 square foot single-story home, comparing kiln-dried (KD) spruce wood at 16″ o.c. with various steel configurations on the basis of pre-COVID material pricing. The results showed near parity, with wood maintaining a slight edge:

| Material | Stud Spacing | Total Cost | Cost per sqft | Cost vs. Wood | Cost vs. Wood per sqft |

|---|---|---|---|---|---|

| Lumber (KD Spruce) | 16″ o.c. | $21,264.11 | $10.03 | n/a | n/a |

| Cold-Formed Steel (3-1/5 & 5-1/2 studs) | 24″ o.c. | $21,640.65 | $10.21 | +$376.53 | +$0.18 |

| Cold-Formed Steel (3-1/5 & 5-1/2 studs) | 16″ o.c. | $23,865.06 | $11.26 | +$2,600.95 | +$1.23 |

| Cold-Formed Steel (3-5/8 & 6″ studs) | 16″ o.c. | $24,291.94 | $11.46 | +$3,027.82 | +$1.43 |

Here, the optimized 24″ o.c. steel option was only 1.8% more expensive than wood, but it provided superior strength and allowed for fewer materials. Labor rates were higher for steel ($6.25/sq. ft. vs. $5.25 for wood), but this was offset by faster installation and less waste. Essentially, even at these costs, a prospective end-user would realize a vast benefit in quality and performance of steel relative to wood at an essentially identical cost.

The COVID-19 pandemic amplified lumber’s volatility, with prices spiking significantly, as discussed earlier in this article, due to mill closures, demand surges, and supply chain disruptions. Post-COVID, the gap has widened in steel’s favor, as builders grapple with ongoing high lumber costs and delays that persist into 2025. Despite some recent declines, lumber prices remain approximately 80% higher than pre-pandemic levels, significantly inflating homebuilding expenses and prompting a shift toward alternatives like cold-formed steel.

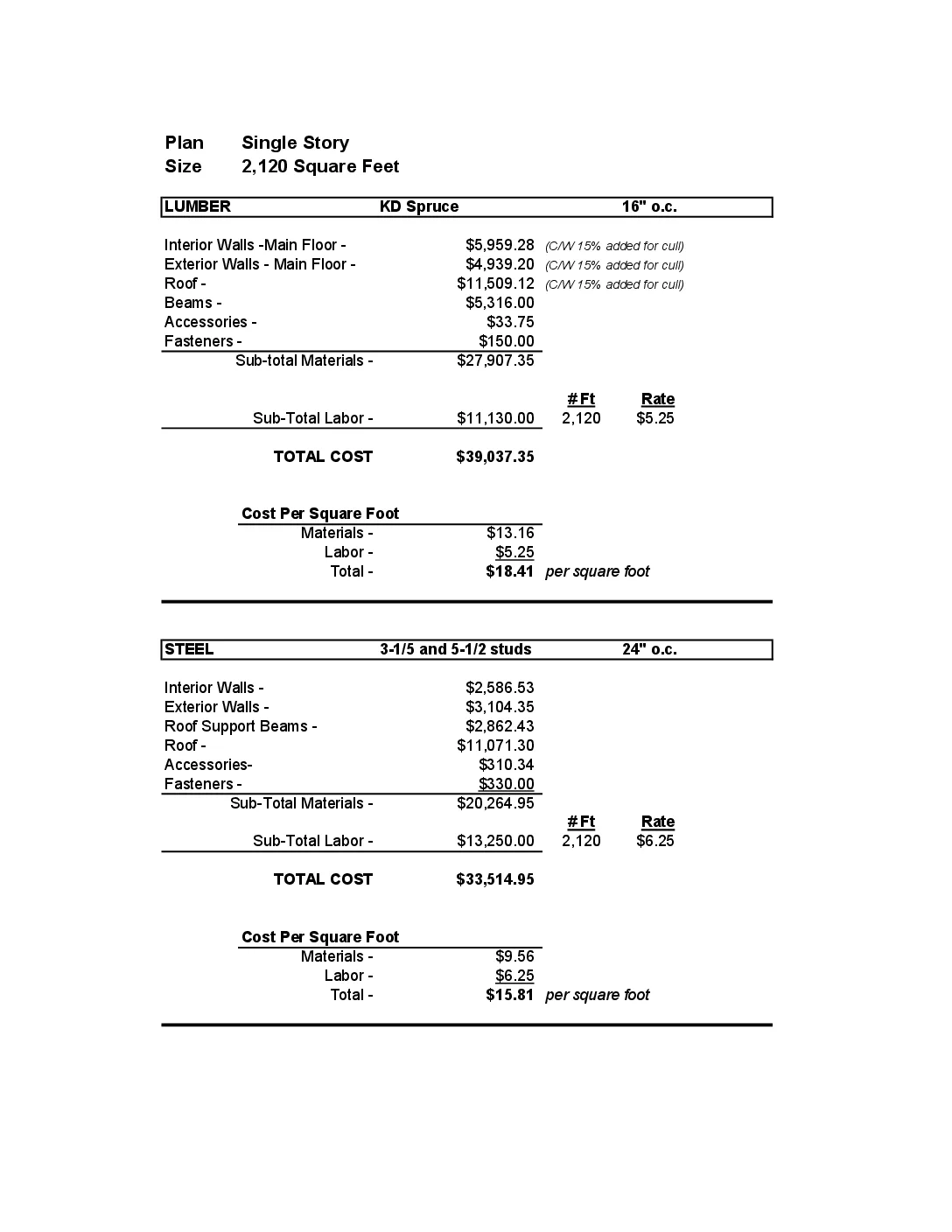

Unsurprisingly, the very same SFIA single-family 1,120-sqft dwelling study presented above, revisited in July 2022 for the material and construction costs then valid, reflecting inflated prices. However, the relative comparison between the two materials now revealed a significantly different picture, now convincingly in favor of cold-formed steel:

| Material | Stud Spacing | Total Cost | Cost per sqft | Cost vs. Wood | Cost vs. Wood per sqft |

|---|---|---|---|---|---|

| Lumber (KD Spruce) | 16″ o.c. | $39,037.35 | $18.41 | n/a | n/a |

| Cold-Formed Steel (3-1/5 & 5-1/2 studs) | 24″ o.c. | $33,514.95 | $15.81 | -$5,522.40 | -$2.60 |

| Cold-Formed Steel (3-1/5 & 5-1/2 studs) | 16″ o.c. | $38,968.66 | $18.38 | -$68.69 | -$0.03 |

| Cold-Formed Steel (3-5/8 & 6″ studs) | 16″ o.c. | $40,035.84 | $18.88 | +$998.49 | +$0.47 |

Future Trends in Wood vs. Steel Framing

As of August 31, 2025, lumber prices have stabilized but remain elevated at around $550-623 per mfbm, down 3.7% week-over-week but up 23% year-over-year due to tariffs on Canadian imports (potentially rising to 34.5%) and sawmill closures. Steel prices, according to Trading Economics have, on the other hand, remained nearly flat on a year-over-year basis over the same period.

Looking to 2025-2030, lumber faces ongoing upward pressure from tariffs, supply constraints, and climate impacts, with prices expected to remain above pre-pandemic levels and volatile. Steel prices are projected to rise moderately (e.g., due to global demand), but with less volatility, thanks to recycling and domestic production. Experts predict lumber increasing 6-17% annually in spots, while steel holds steady.

For insights into U.S. wood price issues, watch this video: Why Lumber Prices Are So High. Additionally, for a focused discussion on why builders are turning to steel amid persistent lumber highs, refer to this analysis: Builders Look to Steel Framing as Lumber Prices and Delays Remain High.

Total Cost of Ownership: Why Steel Wins Long-Term

Beyond initial construction, total cost of ownership (TCO) seals steel’s advantage. Wood-framed structures deteriorate much faster than resilient steel framed homes, with issues like rot, termites, and moisture leading to repairs costing thousands annually. An NPR report highlights how deteriorating wood homes worsen the housing shortage, with waitlists for repairs stretching years and costs up to $50,000 per home.

Steel avoids these: It’s termite-proof, mold-resistant, and fire-retardant, reducing insurance premiums by 10-20% and maintenance by up to 50% over 20 years. A 20-year analysis showed steel TCO 15% lower than wood.

Consider also the Beaufort Demonstration Homes project, where steel framing proved cost-competitive with wood while offering better performance. In residential projects, steel’s precision reduces callbacks, saving 5-10% on warranties.

A notable example amid high lumber prices is Ellisdale Construction’s five-story addition in Washington D.C., where switching to cold-formed steel saved $1.7 million, showcasing steel’s ability to deliver substantial cost reductions even in larger-scale projects.

Scottsdale’s systems exemplify this, enabling off-site panelization that cuts build time by weeks.

Are all the Cold-Formed Steel Framing Solutions the Same?

While the conventional cold-formed steel framing methods, as shown in this article, advanced steel-framing automation technologies in the form of next-generation roll forming machines with design/engineering/CNC integrations raise the advantages of cold-formed steel even further. As an example, consider the real-world framing application of steel-framed cold-formed steel truss system. Scottsdale’s proprietary Scottruss system powered by its ScotSteel software solution vastly outperformed the inferior Framecad system, saving 34% by weight alone compared to Framecad. While Scottruss utilizes proprietary hat-channel profiles optimized for truss behavior, including better performance in compression and flexural buckling, Framecad’s solution. Compared to the end-to-end automation and efficiency of Scottruss by Scottsdale, the Framecad system, although costlier, was based on an inefficient inline truss configuration which greatly limits the structural performance, particularly in truss chords subject to the combined compression and bending action. To make matters worse, rather than unfolding the lips at the work points connecting chord and web members in a truss (i.e., as is the case with Scottsdale’s Scotpanel inline truss system which preserves the significant portion of section capacity), the Framecad system accomplishes connectivity through a lip-cut feature, thus weakening the chord section structurally at the point of the most critical interaction of negative bending and compression. Click here to view the details of the unedited third-party engineering comparison.

Check out what others say about Scottruss here.

In summary, the many advantages of cold-formed steel framing over wood can be amplified manyfold through software-powered next-generation steel framing solutions provided by Scottsdale systems, integrating roll forming, design and engineering, CNC production, and fabrication all in one environment.

Conclusion: Steel as the Decisive Choice

In summary, while wood has historical appeal, steel framing offers decisive advantages in cost stability, construction efficiency, and long-term value. With lumber’s volatility persisting into 2030 and steel’s trends favoring predictability, builders and homeowners should prioritize steel for resilient, cost-effective homes. For more on steel’s benefits, explore Advantages of Steel Structures. By choosing steel, you’re not just building a house—you’re investing in the future.